When the Carve-In Happens, Don’t Get Carved Up.

Inclusion of hospice in Medicare Advantage is all-but-guaranteed to happen in the coming years. How can you prepare to contract with private payers?

The Medicare Advantage juggernaut

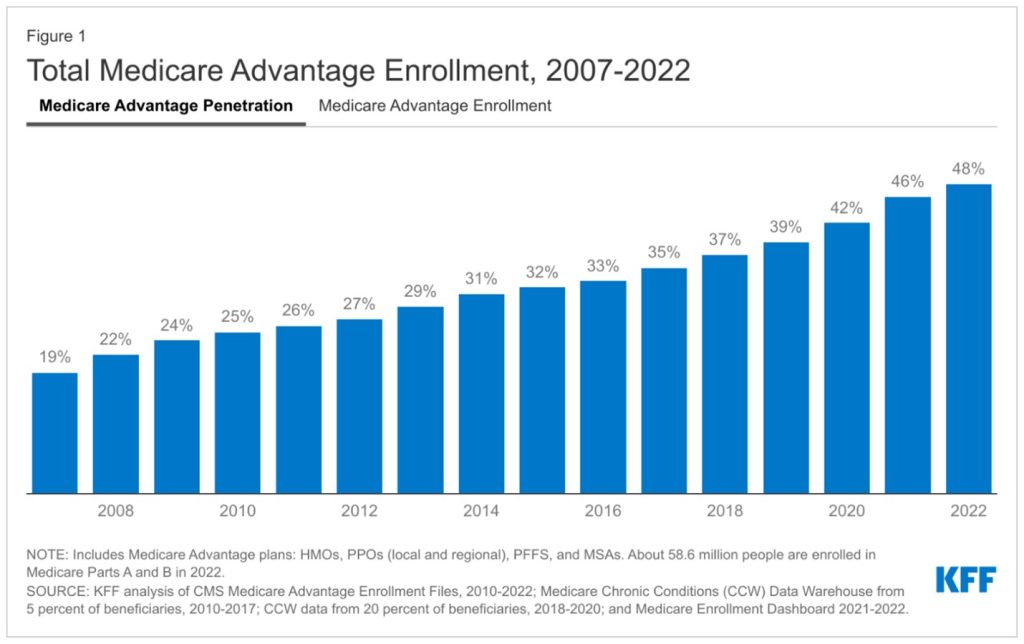

The growth in Medicare Advantage (MA) has been significant in the last decade, swelling from 27% of all enrollees in 2012 to 48% in 2022. This number is expected to grow to upwards of 61% of Medicare enrollees in the next decade.

Kaiser Family Foundation, Medicare Advantage in 2022: Enrollment and Key Trends

Medicare Advantage is here to stay. Beneficiaries like the smaller co-pays, enjoy the additional coverage options such as dental and vision, and don’t seem to mind the trade-off of narrower networks and prior authorization requirements. They’re voting with their wallets and rapidly moving to these plans.

Why does this matter to hospice? After all, the Medicare Hospice Benefit isn’t covered under MA. An MA beneficiary who is eligible for hospice reverts to fee-for-service (Medicare Part A), and the hospice receives the same per-diem reimbursement for any type of Medicare patient they serve. This is sometimes referred to as hospice being “carved out” of MA.

However, the status quo doesn’t always stay that way for long. As the “silver tsunami” of baby boomer retirees swell enrollment, the Medicare trust fund is dwindling. There is bipartisan policymaker agreement that Medicare Advantage plans are a useful tool to begin shifting the risk and administrative costs of healthcare to the private sector with a goal of lowering spending and incentivizing quality outcomes. It’s unlikely that hospice will remain outside of MA for very long. The days of status quo reimbursement are almost certainly numbered.

Change is already in motion

While still exempt from MA, updates to the hospice benefit are underway. The Centers for Medicare and Medicaid Services (CMS) have made changes to payment methodology for hospice in recent years, increasing reimbursement for the initial days of routine care and lowering them after day 60. Additionally, hospices are now given additional reimbursement for certain nurse and social work visits in the last seven days of life for hospice patients, an acknowledgement of the increased acuity and symptom management patients can require in that final week.

Perhaps more striking is the inclusion of hospice in the Value-Based Insurance Design (VBID) program. Run by the Centers for Medicare and Medicaid Innovation (CMMI), this program is actively piloting inclusion of hospice in Medicare Advantage plans. Under this demonstration, participating MA plans can develop closed networks that rely only on contracted hospices to provide care to their beneficiaries (currently, any Medicare patient can choose any hospice that serves their geographic area). MA plans also have the ability to negotiate rates with contracted hospices. From Transcend’s experience with our clients who provide care under the Medicare Home Health Benefit (which is already carved into MA), these negotiations almost always start with rate reductions from the fee-for-service episodic payment schedules. CMS is committed to the VBID program, having recently extended the pilot through 2030.

The program also allows for some exciting potential innovations, such as providing hospice care concurrent to curative treatments and encouraging palliative care payer arrangements. These represent significant longer-term opportunities for forward-thinking hospice providers.

How should you go about growing your continuum of care and increasing your appeal to MA plans? Check out Transcend’s Stan Massey and Rhonda Sanders of Empath Health as they discuss expanding the continuum of care in this Transcend podcast.

Proving your value to payers

The signs are pointing towards a need for hospices to contract with MA plans and other value-based providers, like Accountable Care Organizations or managed Medicaid providers. MA contracting may not be here yet, but it’s coming. What can your hospice do to start preparing?

The Transcend team has identified some key areas for providers to begin focusing on as they manage the likely changes coming for hospice. While these areas aren’t exhaustive, they can help to give a framework to an organization’s future plans for interacting with payers of all kinds.

1. Be ready to articulate and refine YOUR value proposition. Every hospice is caring and compassionate. We know that hospice has higher quality and satisfaction scores than deaths in other settings. We know that hospice saves the system money. All of these points are “table stakes,” so to speak, and aren’t what differentiates your program from your competitor. What providers really need to articulate when contracting with a payer is why they’re the best hospice to partner with, and why they deserve adequate compensation for their services. Why should an MA plan work with you as their in-network provider as opposed to the hospice across the street? Refining this differentiated value proposition will be key. Maybe it’s a robust palliative care offering or a geographic service area that covers a significant portion of an insurer’s members. Perhaps you have higher Care Compare and CAHPS scores than your competitors. Knowing what makes you the agency MA plans should contract with is a crucial step in the process. Also recognize that you’re in a negotiation – don’t be surprised if a plan starts a conversation around significantly lower reimbursements than fee-for-service rates. Think through how you’ll respond; understand what you can and can’t accept; and consider trade-offs of volume or perhaps contracting for other services, such as palliative care or unskilled aide care, to offset potentially lower rate reimbursements.

2. Data, data, data. Investing in your ability to prove outcomes to payers is an organizational competency you’ll need, and not just once or twice a year. Showing your impact on the total cost and quality of care will start with key metrics, such as quantifying how you lower ER visits and head off rehospitalizations, your live discharge rates, your CAHPS results and length of stay, among others. PEPPER reports can also provide useful context about your metrics relative to your local, state and national peers. Building the capacity to pull these reports on a regular basis is something providers should be working on now and investing ahead in the EMR and analytics capabilities to attain them on-demand.

3. Learn the players, learn the process. MA plans don’t always post their contracting process or key contacts on the front page of their websites. It will take some good old-fashioned digging to uncover who at an MA plan you should engage with. Activate your network of professional contacts in post-acute care to understand these nuances and stakeholders. Ask your boards; leadership teams; and counterparts at hospitals, home health agencies or DME companies who they deal with at an MA plan and start building profiles. Learn how the process works and if there are certain windows when MA plans open their negotiations. Be prepared to educate these contacts also – many MA plans don’t have much familiarity with the nuances of the Medicare Hospice Benefit and may need context around operations or patient/family needs.

Now is the time

It’s entirely possible that this blog post raises many more questions than answers for your agency. The good news is that now is the time to be courageous and start planning for what’s coming. Many Transcend clients are starting down the path of preparing for a world with Medicare Advantage and value-based contracting. If you need help refining your value proposition or strategically positioning your offerings to new stakeholders like MA plans, contact us at hello@transcend-strategy.com to start a conversation.