Don’t Discount the Clout of Consumer Marketing

A funny thing happened on the way to marketing hospice and other home-based care. Most providers essentially ignored targeting the actual recipients of their services – patients and their families. What other services can you think of that pay such relatively little attention to their key target audience?

I understand how this phenomenon happened. Conventional wisdom says that most forms of medical care – including hospice and other home-based clinical services – require a referral from a physician or other medical professional. So, the primary strategy of providers has long been to focus on professional referrers – physicians, hospital discharge planners or case managers, and/or the clinical decision makers at skilled nursing centers.

As a result, the vast majority of providers end up going after the same prospects in much the same way. And that conformity often leads to crowded competition and fragmented market share from predictable referral patterns.

It’s also a big part of why admissions to hospice care nationally come from quite a lopsided referrer mix. On average, 47.3% come from hospitals; 19.3% from physicians; and 13.3% from SNFs. Meanwhile, only 12.4% come from family/self-referrals.

And that’s where a huge difference in strategy comes into play.

Zig while your competitors zag: Home in on patients and families.

Hospice care is one service where patients or family members can self-refer. Sure, after the self-referral is made, physicians must get involved to help confirm eligibility and enable admission. But “everyday people” in need of support can open the door to a referral and start the ball rolling.

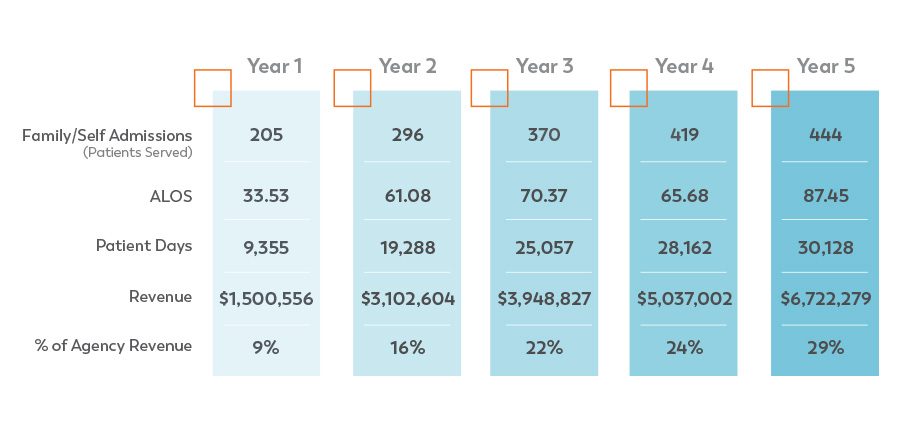

The importance of marketing to patients, their families and especially their family caregivers cannot be overstated. For hospice care, Transcend’s 20 years of experience show that self-referrals are often the catalyst for significant increases in census and length of stay. The chart below reports just one of our client’s year-over-year growth in admissions, LOS, patient days and the resulting revenue – and this is only from the family/self-referral category! Clients who fully follow our family-focused strategy typically experience topline revenue growth from 100 to 400%.

For home care services upstream from hospice, establishing a relationship with patients and families earlier in the progression of care helps providers maintain those relationships throughout the continuum – even if the initial referral comes from a professional. And, of course, the more a patient remains in a single provider’s continuum, the greater the opportunity to manage quality care while realizing more revenue per patient.

What should marketing to patients and families focus on?

If you’ve never marketed to patients and families before, start with these crucial areas:

- Care education. A major element of marketing to consumers truly is more educational than promotional. Until a serious illness thrusts the need for your care into families’ lives, they don’t think about such matters and know very little about their care options or choices of providers. Consumers need education on the differences between home care, home health, palliative care and hospice care. They also need to be enlightened on facts that dispel myths, especially the misperception of how hospice and palliative care are akin to imminent death. As you educate consumers, make sure you tie that knowledge to your particular brand so that you’re lifting up your organization instead of just the care category. Educators also are perceived as experts, so you will be positioning your brand in a very positive light.

- Brand awareness. Getting patients and families to even recognize your brand name is a big deal. Through Transcend’s surveys of more than 25,000 family healthcare decision makers during the past 20 years, we’ve seen consistently that only 10% or fewer consumers can correctly name a home-based care provider brand with unaided recall. Even when read a list of providers in their area, typically fewer than 40% of consumers say they recognize the brand names. Educating consumers to know your brand and to ask for it by name can be the first leap ahead of your competition.

- Brand differentiation. Among the small minority of consumers who know or recognize home-care provider brand names, 10% or fewer say they can name a difference. By far, the number one difference they name is location. They’re reacting to office buildings, not anything to do with the quality of your care! So, you have to point out what makes your agency different … and better. Even if consumers don’t know your competitors, pepper your marketing with tangible differentiators, such as higher patient and family satisfaction scores, positive outcomes data and evidence of your team’s expertise.

What about all those referrals that still come from professionals?

When home-based care requires a professional referral – or even if a hospice referral comes from a medical professional – it’s still important to include patients and their families in your marketing strategy. Why do you think Big Pharma spends a gazillion dollars each year marketing to consumers when John and Jane Doe can’t write prescriptions for themselves? It’s for brand awareness and recognition when their doctor does prescribe the medication. There’s a psychological comfort when a person thinks, “I’ve heard about that drug before.” Familiarity breeds acceptance and preference.

As you well know, Big Pharma ads also use another tactic – “Ask your doctor if (drug name) is right for you.” So, if the consumer’s physician doesn’t bring up the drug as a possible treatment, John or Jane Doe just might.

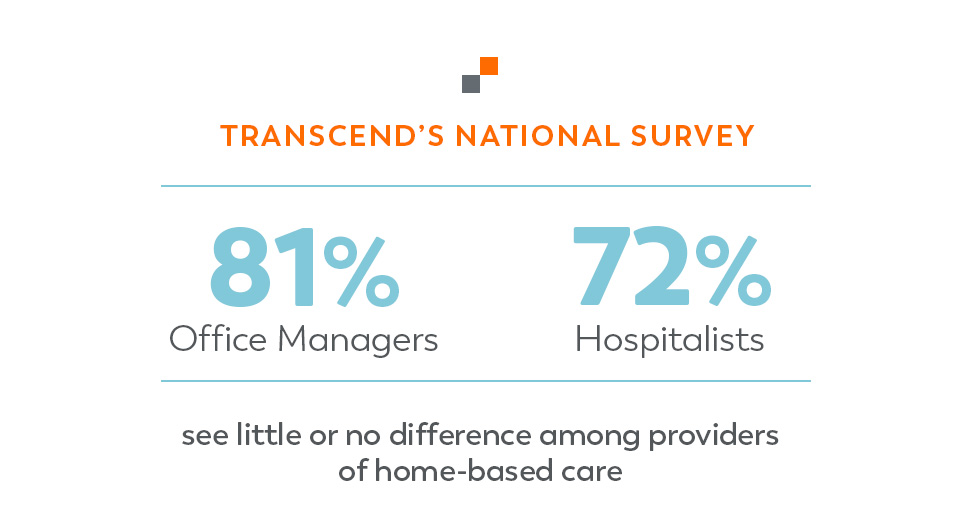

A similar dynamic exists for referrals to home-based care providers. In national surveys Transcend conducted during 2021, 81% of physician office managers and 72% of hospitalists said they see little or no difference among providers of home-based care. Yet about half of them are directly involved in referring their patients to a provider of home-based services.

For some service lines, including hospice care, Medicare rules require referrers to show patients or their caregivers a list of all providers in the area and allow freedom of choice (not to say that this actually happens in many cases). This is just one example of where healthcare consumerism is growing in influence year after year. Many patients and families want to have control over their healthcare decisions, especially if they feel knowledgeable about their options.

So imagine the power if your brand is the only one on the list they recognize. Or when a professional referrer recommends your agency as a choice, consumers will take comfort from “Yes, I’ve heard of them!”

One final note: Professional healthcare referrers are consumers, too. So, as you educate your patient and family audience on brand awareness and differentiation, a good number of referrers also will be learning what sets you apart.

Learn more about marketing to patients and families.

For a deeper dive into these and other key insights Transcend has gleaned from 20 years of consumer surveys in senior care, download our latest research recap. Need help applying these insights to your specific marketing challenges? Feel free to email me anytime at stan@transcend-strategy.com.